If you live in Dubai and you don’t have health insurance, you are putting yourself at risk. There are a number of problems that can arise if you don’t have good medical cover, and they can range from minor to major.

For example, if you need surgery but don’t have insurance, you may have to pay out of pocket for the procedure. That could end up costing you thousands of dollars or dírham. Or, if you get sick or injured and need to be hospitalized, your bills could easily run into tens of thousands of dollars.

In other words, not having health insurance in Dubai is a very risky proposition. Do you like to put your health or your family’s health at risk?

We don’t want to worry you, we know that health insurance is an additional cost to your life. But, if we offer you a fantastic cover at a low price, what would you think? Is today your lucky day? Well, here we offer you: Cheap Health Insurance in Dubai?

See you for the best health insurance prices in Dubai.

Contents

Why take out a Health Insurance Policy?

Medical insurance is a type of insurance that helps protect you financially if you need to go to the hospital. It can help cover the cost of surgery, medical treatment, and hospitalization. Most medical insurance policies also provide coverage for other medical expenses, such as prescriptions and dental care.

Medical insurance can be expensive, but it’s important to have some form of coverage in case you need to go to the hospital. If you don’t have health insurance, you could end up paying thousands of dollars for your medical care.

That’s why it’s important to shop around and find a policy that fits your needs and your budget. You can compare health insurance policies online, and most insurers offer free quotes.

Remember, medical insurance is an important safety net in case of an emergency. Make sure you are protected by purchasing a policy today.

What types of Health Insurance we can get in the UAE

Medical insurance in Dubai is available in a variety of different formats, each catering to a specific need. The most common types of medical insurance plans in Dubai are individual plans, family plans, and group plans.

There are different types of medical insurance plans in the UAE that one can opt for.

- Individual medical insurance plans are offered by insurance companies to a single policyholder and offer coverage against specific illnesses. Benefits may include cashless hospitalization, pre- and post-hospitalization care, and more. The entire sum assured is provided to only one person.

- Family medical insurance plans are designed to cover the entire family under one policy. Plans usually restrict the number of policyholders to one spouse and a fixed number of children, but some insurers offer plans that cover extended families. The sum assured is per person in the insurance plan for family insurance.

- Senior citizen health insurance plans are specifically designed for those 60 years old and older. Please note that these policies may have a higher premium due to the increased risk of illness among seniors. However, many insurers in Dubai offer senior citizen health insurance plans, and applicants are often required to undergo a medical check-up before being approved for coverage.

- Group medical insurance plans are typically provided by employers and are created to include and exclude employees as they join and leave the organization. Group medical insurance plans are usually low in premium because there are typically more applicants.

- Critical illness coverage is a type of health insurance that covers certain illnesses regardless of whether or not they are pre-existing conditions. Coverage for critical illness varies by insurer, so be sure to read the fine print when shopping for a policy.

How to Compare Health Insurance Plans in the UAE?

Now that we know the types of health insurance plans available in Dubai, let’s take a look at how to compare them. There are a few things you should keep in mind when comparing health insurance plans:

- The type of coverage you need: Do you need an individual plan or a family plan? What type of coverage do you need?

- Your budget: How much can you afford to pay for your health insurance premium?

- The insurer: Make sure you are familiar with the insurer and that they have a good reputation.

- The network of hospitals: Most insurers in Dubai have a network of hospitals that they have agreements with. Make sure the hospital you want to go to is included in the insurer’s network.

- The excess: The excess is the amount you will have to pay before your insurance policy kicks in. Make sure you are comfortable with the excess before you purchase a policy.

- The waiting period: Some health insurance policies have a waiting period before you can make a claim. Make sure you are aware of the waiting period before you purchase a policy.

- The benefits: Make sure the policy you are considering covers the benefits that are important to you.

Now that you know what to look for when comparing health insurance plans, let’s take a look at some of the best health insurance companies in Dubai.

What does the Dubai Health Insurance Market offer?

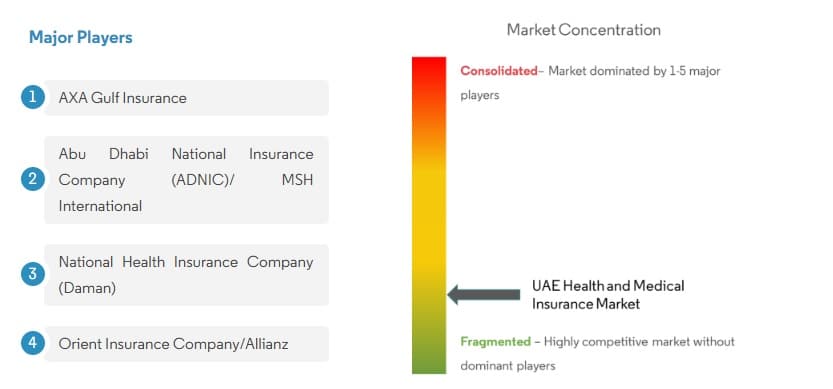

If you are looking for health insurance in Dubai, there are a few things you should know. The UAE health insurance sector is overcrowded, with too many players competing for too little market share in the overall market. There are players with less than 0.01% market share within the industry.

The Dubai Health Authority had granted licenses to 50 of the UAE’s 62 insurance companies, 23 of the 25 third-party administrators (TPAs) licensed by the UAE Insurance Authority, and 103 out of 201 of the brokers or intermediaries that operate in the market.

If you are looking for medical insurance in Dubai, then you should consider Daman. Daman is the largest insurance payer in Abu Dhabi and the third-largest in Dubai. It effectively manages the public health programs of ‘Thiqa’ for UAE nationals in Abu Dhabi, and also covers the Abu Dhabi basic health plan for low income expats in the emirate.

Daman offers a wide range of health insurance plans that provide comprehensive coverage for both inpatient and outpatient treatment, as well as preventive care. Daman also has a network of over 1,000 providers, which gives you the peace of mind that you will be able to find the treatment you need.

If you are looking for an insurance company that can provide you with comprehensive coverage and a wide range of benefits, then Daman is the right choice for you.

Price and Services – TOP 6 Health Insurance Companies in Dubai

If you are a resident of Dubai, then you know that healthcare is not free. In fact, it can be quite expensive, depending on the treatment or procedure you require. This is why many people choose to purchase health insurance.

There are many health insurance companies in Dubai, but not all of them offer the same services or prices. In this article, we will review the six best health insurance companies in Dubai. We will compare their prices and services so that you can make an informed decision about which company is right for you.

| The Company | Prices | Coverage |

|---|---|---|

| AXA Insurance | 677 AED/Year | Direct billing for in-patient and out-patient treatment within the UAE, pre-existing and chronic conditions, maternity cover. |

| DAMAN | From AED 615 to 800 | in-patient, out-patient, maternity and emergency services, local health insurance. |

| Oman Insurance | AED 560 | In-patient and out-patient services, emergencies, laboratory, maternity, over 500 hospitals / clinics and 1,400 pharmacies. |

| Metlife Alico | AED 761 (Domestic Help), AED 1,312 (For Dependents) | Medical visits to a general doctor in UAE, in-patient treatments, emergency medical treatments or hospitalization, diagnostic tests, maternity services, prescription drugs, physiotherapy, preventive services (DHA mandatory vaccines and immunizations). |

| Takaful Emarat | Starting from AED 525 | Tests, diagnosis, treatments and surgeries in hospitals for non-urgent medical cases (Prior approval required), in-patient and outpatient services, maternity cover. |

| RAK Insurance | Starting from AED 485 | Tests, diagnosis, treatments and surgeries in hospitals for non-urgent medical cases (Prior approval required), in-patient and outpatient services, maternity cover, day care services, emergencies. |

Take a look at the comparison table we have created to give you a complete overview of the medical services available in Dubai.

Now that you know what to look for when comparing health insurance plans, let’s take a look at some of the best health insurance companies in Dubai. If you are looking for health insurance in Dubai, you should consider Daman. Daman is the largest insurance payer in Abu Dhabi and the third largest in Dubai. It effectively manages the “Thiqa” public health programmes for UAE nationals in Abu Dhabi, and also covers Abu Dhabi’s basic health plan for low-income expatriates in the emirate.

Daman offers a wide range of health insurance plans that provide comprehensive coverage for both inpatient and outpatient treatment, as well as preventive care. Daman also has a network of more than 1,000 providers, giving you peace of mind that you can find the treatment you need.

If you are looking for an insurance company that offers comprehensive coverage and a wide range of benefits, Daman is the right choice for you.

We hope this article has been helpful in providing you with information.

Hi, I’m Sharif and this is my website where I offer information and advisory services in the United Arab Emirates. I invite you to read and comment on my articles. If you want to know more about my visit, about me .